Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

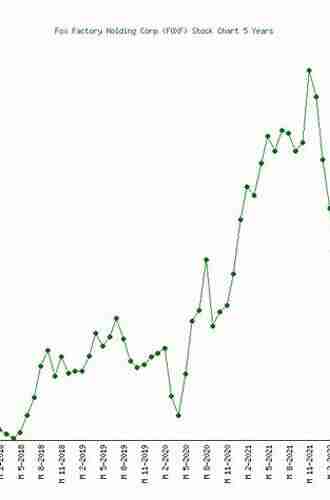

Price Forecasting Models For Fox Factory Holding Corp Foxf Stock Nasdaq: A Comprehensive Analysis

Are you looking to invest in Fox Factory Holding Corp's stock, listed on Nasdaq under the ticker symbol FOXF? As an investor, it is crucial to have reliable price forecasting models that can help you make informed decisions and maximize your investment returns.

Understanding Fox Factory Holding Corp

Fox Factory Holding Corp, headquartered in California, is a leading global designer, manufacturer, and marketer of performance suspension products used in mountain bikes, motorcycles, off-road vehicles, and trucks. Over the years, the company has gained a strong reputation for its innovative products, quality craftsmanship, and commitment to customer satisfaction. With a solid presence in the market, Fox Factory Holding Corp has attracted the attention of investors seeking growth opportunities in the automotive industry.

The Importance of Price Forecasting

Price forecasting plays a vital role in investment decision-making. It provides investors with valuable insights into potential price movements of a stock, allowing them to identify profitable entry and exit points. Reliable price forecasting models are based on comprehensive analysis of historical price data, market trends, industry developments, and various other factors that can impact the stock's future performance.

5 out of 5

| Language | : | English |

| File size | : | 1051 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 26 pages |

| Lending | : | Enabled |

| Paperback | : | 73 pages |

| Item Weight | : | 4.3 ounces |

| Dimensions | : | 6 x 0.19 x 9 inches |

Types of Price Forecasting Models

There are several types of price forecasting models used by financial analysts and investors. These models can broadly be categorized into fundamental analysis and technical analysis.

1. Fundamental Analysis

Fundamental analysis is a method of evaluating a stock's intrinsic value by analyzing various factors such as financial statements, industry trends, competitive landscape, and macroeconomic indicators. This model focuses on the underlying factors that drive a company's performance and determines its fair value. Investors who rely on fundamental analysis use metrics like earnings per share (EPS),price-to-earnings (P/E) ratio, and return on equity (ROE) to estimate the stock's future price.

2. Technical Analysis

Technical analysis, on the other hand, involves studying historical price charts, patterns, and volume data to predict future price movements. This model assumes that historical price patterns tend to repeat themselves, and traders can make profitable trades by identifying these patterns. Technical analysts use various tools like moving averages, trend lines, and oscillators to analyze price trends and identify potential entry and exit points.

Combining Fundamental and Technical Analysis

While both fundamental and technical analysis have their strengths and limitations, many successful investors use a combination of both models to make informed investment decisions. By considering both the fundamental factors that drive a company's performance and the technical indicators that suggest price movements, investors can have a more comprehensive understanding of the stock's potential.

Price Forecasting Models for Fox Factory Holding Corp

Given Fox Factory Holding Corp's growth potential and strong track record, it is essential to delve into the price forecasting models specific to this company. Combining fundamental analysis with technical analysis can provide a holistic view of the stock's future performance.

1. Fundamental Analysis for Fox Factory Holding Corp

When utilizing fundamental analysis for Fox Factory Holding Corp, investors should consider factors such as the company's financial statements, revenue growth trends, market share, and competitive advantages. By analyzing these factors, investors can estimate the company's future earnings potential and determine its intrinsic value. This analysis can be further supported by considering industry trends, macroeconomic factors, and the company's growth strategies.

For example, if Fox Factory Holding Corp is expanding its product line to cater to new markets or entering into strategic partnerships, it may indicate potential revenue growth and increased market share. This information can be factored into the forecasted price calculation using appropriate valuation models, such as discounted cash flow (DCF) analysis or price-to-earnings (P/E) ratio analysis.

2. Technical Analysis for Fox Factory Holding Corp

Technical analysis for Fox Factory Holding Corp involves the evaluation of historical price patterns, volume trends, and various technical indicators. Traders and investors use different tools and chart patterns to explore potential entry and exit points. For instance, observing moving averages, such as the 50-day or 200-day moving average, can help identify trends and potential support or resistance levels.

Furthermore, oscillators like the relative strength index (RSI) can indicate overbought or oversold conditions, aiding in decision-making. Analyzing chart patterns, such as ascending triangles or head and shoulders patterns, can provide insights into potential breakout or reversal points.

Using Machine Learning for Price Forecasting

In recent years, advancements in technology and the availability of vast amounts of data have paved the way for the utilization of machine learning algorithms in price forecasting models. Machine learning algorithms can analyze large datasets, identify patterns, and make predictions based on the analyzed data.

Applying machine learning to price forecasting models for Fox Factory Holding Corp can provide more accurate and reliable predictions. By training the algorithms on historical price data, along with relevant fundamental and technical indicators, investors can obtain forecasts that are more reflective of the stock's potential.

Price forecasting models are essential tools for investors seeking to maximize their investment returns. Combining fundamental analysis, technical analysis, and leveraging machine learning algorithms can provide investors with a comprehensive analysis of the stock's potential future price movements.

When analyzing Fox Factory Holding Corp, investors should consider factors such as the company's financial statements, revenue growth trends, market share, and competitive advantages. Additionally, technical analysis should focus on historical price patterns, volume trends, and various technical indicators to identify potential entry and exit points. By using these models in conjunction and considering the specific dynamics of Fox Factory Holding Corp, investors can make more informed investment decisions and potentially enhance their returns.

5 out of 5

| Language | : | English |

| File size | : | 1051 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 26 pages |

| Lending | : | Enabled |

| Paperback | : | 73 pages |

| Item Weight | : | 4.3 ounces |

| Dimensions | : | 6 x 0.19 x 9 inches |

Do you want to earn up to a 8248% annual return on your money by two trades per day on Fox Factory Holding Corp. FOXF Stock? Reading this book is the only way to have a specific strategy.

This book offers you a chance to trade FOXF Stock at predicted prices. Eight methods for buying and selling FOXF Stock at predicted low/high prices are introduced. These prices are very close to the lowest and highest prices of the stock in a day.

All methods are explained in a very easy-to-understand way by using many examples, formulas, figures, and tables. The BIG DATA of the 1767 consecutive trading days (from August 8, 2013 to August 13, 2020) are utilized. The methods do not require any background on mathematics from readers. Furthermore, they are easy to use. Each takes you no more than 30 seconds for calculation to obtain a specific predicted price.

The methods are not transient. They cannot be beaten by Mr. Market in several years, even until the stock doubles its current age. They are traits of Mr. Market. The reason is that the author uses the law of large numbers in the probability theory to construct them. In other words, you can use the methods in a long time without worrying about their change.

The efficiency of the methods can be checked easily. Just compare the predicted prices with the actual price of the stock while referring to the probabilities of success which are shown clearly in the book (click the LOOK INSIDE button to read more information before buying this book). Depending on the number of investors who are interested in this book, the performance of the methods from the publication date will be added to the book after one year, and will be stated here in the description of the book too. You will then see that the methods in this book are outstanding or not.

The book is very useful for

- Investors who have decided to buy the stock and keep it for a long time (as the strategy of Warren Buffett),or to sell the stock and pay attention to other stocks. The methods will help them to maximize profits for their decision.

- Day traders who buy and sell the stock many times in a day. Although each method is valid one time per day, the information from the methods will help the traders buy/sell the stock in the second time, third time or more in a day.

- Beginners to FOXF Stock. The book gives an insight about the behavior of the stock. They will surely gain their knowledge of FOXF Stock after reading the book.

- Everyone who wants to know about the U.S. stock market.

Tim Reed

Tim ReedDiscover the Success Story of Robert Smallwood - The...

Have you ever wondered how some...

Dallas Turner

Dallas TurnerSuperheavy Making And Breaking The Periodic Table

Throughout history, mankind has always...

Carter Hayes

Carter HayesAdaptable Tactics For The Modern Game

The modern game of football is...

Colby Cox

Colby CoxDiscover the Joy of Learning Quilting Skills and...

Are you ready to embark on a...

Jeffery Bell

Jeffery BellThe Olympic Dream: Matt Christopher's Incredible Journey

Are you ready for an inspiring story...

Banana Yoshimoto

Banana YoshimotoGerman Army And Waffen SS: The Last Battles In The West...

As history buffs and...

Duane Kelly

Duane KellyThrough Fields, Forests, And Mountains: Exploring the...

Picture yourself embarking on an...

Ira Cox

Ira CoxThe Colonization Of Mars: A Most Mysterious Journey

Ever since the dawn of human civilization,...

Natsume Sōseki

Natsume SōsekiImperium Arlie Russell Hochschild - Understanding the...

The contemporary political landscape is a...

Hamilton Bell

Hamilton BellThe Philosophy Of Mathematics Education Studies In...

The philosophy of mathematics education is...

Dalton Foster

Dalton FosterPractice Girl Estelle Laure: Unleashing Her Voice through...

Imagine a world where music is not just a...

Hayden Mitchell

Hayden MitchellAnnie Laurie And Azalea Elia Wilkinson Peattie

A Journey Through the Lives of...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

John UpdikeThe Shadow Lantern Blackhope Enigma: Unveiling the Mysteries of an Intriguing...

John UpdikeThe Shadow Lantern Blackhope Enigma: Unveiling the Mysteries of an Intriguing... Zadie SmithFollow ·14k

Zadie SmithFollow ·14k Jackson HayesFollow ·4.7k

Jackson HayesFollow ·4.7k Isaac AsimovFollow ·6.7k

Isaac AsimovFollow ·6.7k Shaun NelsonFollow ·5.2k

Shaun NelsonFollow ·5.2k Howard BlairFollow ·16.7k

Howard BlairFollow ·16.7k Wade CoxFollow ·18.1k

Wade CoxFollow ·18.1k Thomas PynchonFollow ·6.7k

Thomas PynchonFollow ·6.7k Dion ReedFollow ·8.8k

Dion ReedFollow ·8.8k